Calculate bond value

Bond Face ValuePar Value - Par or face value is the amount a bondholder will get back when a bond matures. Add the sum of each company account investment and bond to determine the total like this.

How To Calculate Value At Risk Var In Excel Investing Standard Deviation Understanding

Calculator Results for Redemption Date 092022.

. Calculate price of a semi-annual coupon bond in Excel. Here is the formula for the bond price that. All deal in thousands of companies stocks.

Determine the face value. The present value of such a bond results in an outflow from the purchaser of the bond of -79483. It is the product of the par value of the bond and coupon rate.

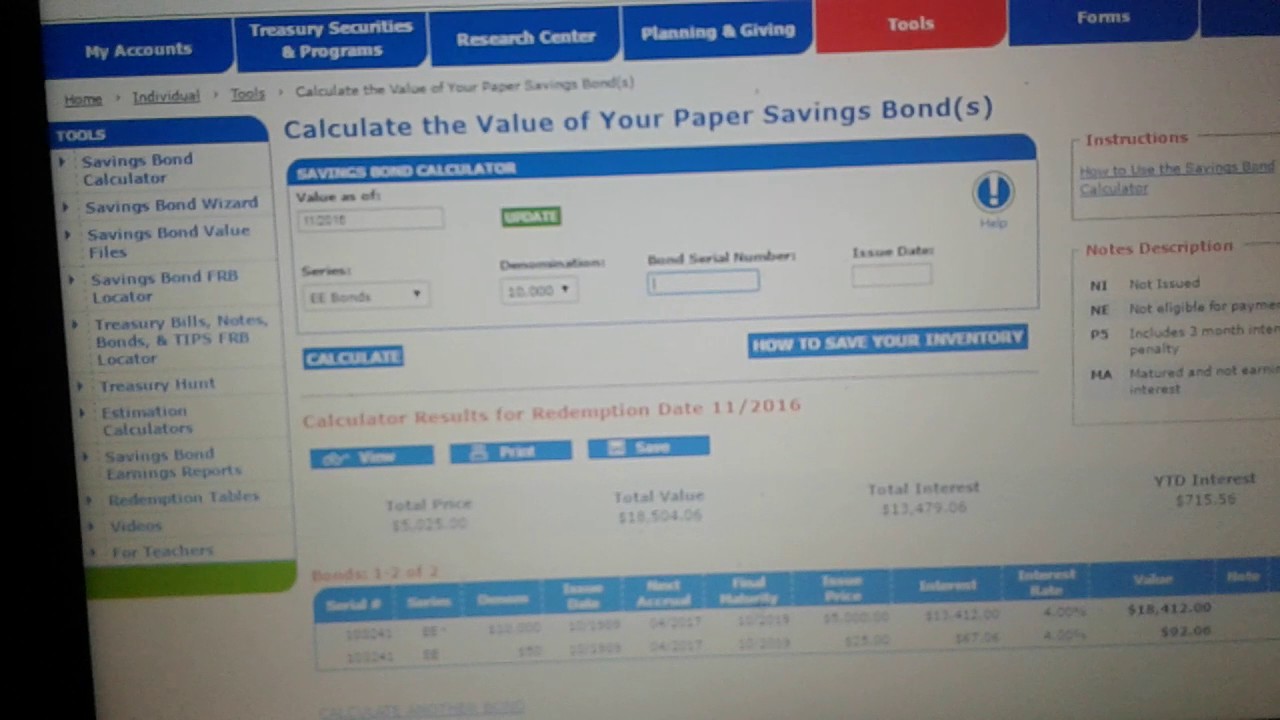

However you can also change the date using the box at top left labeled Value as of If you have an I bond the date chosen must be between the beginning of 1996 and the end of the next compounding period. Calculate the value of a paper bond based on the series denomination and issue date entered. Calculating Yield to Maturity on a Zero-coupon Bond.

Calculate price of an annual coupon bond in Excel. It can be calculated using the following formula. Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond.

The yield to maturity YTM refers to the rate of interest used to discount future cash flows. However if you plan to save an inventory of bonds you may want to enter serial numbers Store savings bond information you enter so you can view or update it later. Calculate the coupon per period.

To calculate a value you dont need to enter a serial number. Following information is given with regard to the bond issue of ABC Company. There are millions of transactions around the worlds stock exchanges every day.

Calculating the present value of a perpetual annuity. Investors looking to invest in a companys stock can find the price of the stock in the stock market. Once you calculate a companys enterprise value calculate the value of several leading competitors for comparison.

How to Use the Savings Bond Calculator. Next determine the rate at which coupon payments will be paid and using that calculate the periodic coupon payments. The face value is the balloon payment a bond investor will receive when the bond matures.

This formula will tell us what a perpetuity is worth based. Therefore such a bond costs 79483. How to Calculate The Market Value Of Debt.

It is assumed that all bonds pay interest semi-annually. How to calculate the fair value. Formula to Calculate Bond Price.

Initially determine the par value of the bond and it is denoted by F. Learn what present value PV and future value FV are and how to calculate present value in Excel given the future value interest rate and period. Future versions of this calculator will allow for different interest frequency.

You can calculate the price of this zero coupon bond. Bonds with Continuous Compounding. At the time of maturity the issuer of a bond will pay the face value to the bearer.

Such as a bond annuity lease or real. We can use a simple formula to calculate the present value of a perpetuity annuity. Stock markets such as the New York Stock Exchange NYSE London Stock Exchange NASDAQ etc.

In reverse this is the amount the bond pays per year divided by the par value. For example there is 10-years bond its face value is 1000 and the interest rate is 500. Maturity value is the amount payable to an investor at the end of a debt instruments holding period maturity date.

Since any business entitys debt is a combination of long-term short-term publicly traded and non-traded loans every instrument has different provisions. The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bonds term. For some certificates of deposit CD and other.

Here is an example calculation for the purchase price of a 1000000 face value bond with a 10 year duration and a 6 annual interest rate. The calculator will automate show your bonds value on the current date. HOW TO SAVE YOUR INVENTORY.

The purpose of this calculator is to provide calculations and details for bond valuation problems. The formula for bond pricing Bond Pricing The bond pricing formula calculates the present value of the probable future cash flows which include coupon payments and the par value which is the redemption amount at maturity. Read more is basically.

Hence he can opt to withdraw from the FD fund as it maxes the present value amount in hand. For our example it is face 1000. To calculate the coupon per period you will need two inputs namely the coupon rate and frequency.

Before the maturity date the bondholder cannot get any coupon as below screenshot shown. You can also analyze how those companies use their debts and how. ABC Incorporation wants to invest in on-the-run treasury bonds Treasury Bonds A Treasury Bond or T-bond is a government debt security with a fixed rate of return and relatively low risk as issued by the US government.

For most bonds the maturity value is the face amount of the bond. Calculate value for a different date. Calculate Present value of a bond Example.

It is denoted by C and mathematically represented as shown below. Face value of the bond 2000 Maturity period of the bond 5 years Annual coupon rate 9 Market interest rate 10. Calculate the Value of Your Paper Savings Bonds SAVINGS BOND CALCULATOR.

Using the Bond Price Calculator Inputs to the Bond Value Tool. HOW TO SAVE YOUR. Discounted Amount for FD 1374335.

Microsoft Excel Bond Yield Calculations Microsoft Excel Coupon Template Excel

How To Calculate Carrying Value Of A Bond With Pictures Cpa Exam Bond Raising Capital

Finding Your Treasury Direct Bond On The Calculator Bond Birth Certificate Statement Template

Bond Yield To Maturity Calculator Printer Driver Organization Development Results Day

Bond Value Calculator Used To Track Price Of Any Bond Corporate Bonds Bond Market Debt Capital Markets

Valuation Of Bond Or Debenture Find Out More Bbalectures Com Bond Business Articles Financial Markets

Bond Amortization Calculator Double Entry Bookkeeping Amortization Schedule Nurse Brain Sheet Mortgage Tips

Bond Price Calculator Online Financial Calculator To Calculate Pricing Valuation Of Bond Based Financial Calculator Financial Calculators Price Calculator

How To Check Or Calculate The Value Of A Savings Bond Online Savings Bonds Earn Extra Cash Bond

Bonds Valuation And Theory Mgt330 Lecture In Hindi Urdu 13 Youtube Lecture Financial Management Bond

Semiannual Coupon Bond Valuation Mgt232 Lecture In Hindi Urdu 10 Youtube Lecture Business Finance Bond

Bond Yield Calculator Online And Free Www Investingcalc Bond Yield Calculator Free Coupon Rate Current Yield Investing Money How To Get Rich Bond

Financial Risk Management What Is Bond Pricing

Pin On Ch 4 Bond Valuation

Calculate The Value Of Your Paper Savings Bond S Savings Bonds Bond Savings

Nominal Value Meaning Importance Drawbacks And More Finance Class Accounting Education Economics Lessons

How To Find The Value Of Premium Bonds Our Deer Bond Stocks And Bonds Investing Money